2022 Iowa Form W-2/1099 Tax Filing Requirements

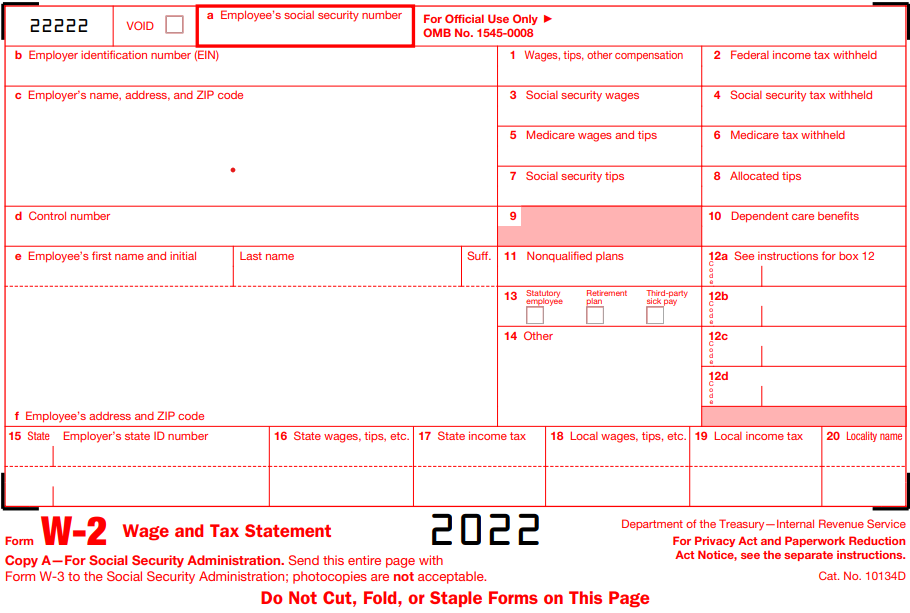

Form W-2

If you are an Employer, and if you have Iowa State tax withholding, you must file Form W-2 with the State of Iowa. Form W-2 is an information return to report the wages paid to the employees and the taxes withheld from them (Social Security, Medicare etc.,).

The State of Iowa mandates the filing of Form W-2 electronically.

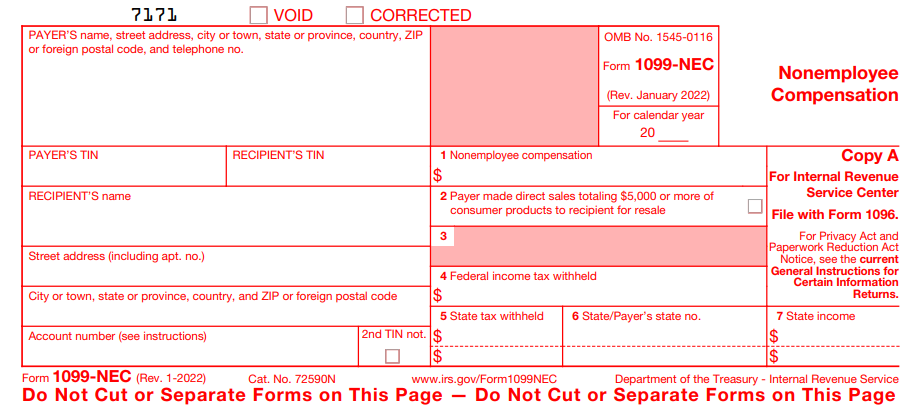

Required 1099 Forms

The State of Iowa mandates the Following 1099 Forms:

Form 1099-MISC - To report payments made to independent contractors, rents, fishing boats proceeds and other

miscellaneous income

Form 1099-INT - To report the payment made as interest income

Form 1099-DIV -To report the payment made as Dividends and Distribution

Form 1099-B - To report the proceeds of broker and barter

exchange transactions

Form 1099-R - To report the amount provided to distributions of Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

The State of Iowa does not participate in the Combined Federal/State Filing Program (CF/SF) program. So you have to file 1099 forms directly to the state if you have Iowa State tax withholding.

Iowa 44-007 Annual Reconciliation Form

You must file the annual reconciliation Form 'Iowa Withholding Annual VSP (Verified Summary of Payment) Report 44-007' to report the Employees/Payees Earnings, State Taxes Withheld during the year. Even if you were not required to withhold Iowa tax, you need to file the VSP showing zero due if you are registered as the withholding agent. Do not send a payment, 1099s, or W-2s with this reconciliation form.

2022 Form W-2/1099 Tax Filing Deadline

Form W-2

W-2 Iowa tax returns are due by

February 15, 2023

Form 1099

1099 Iowa tax returns are due by

February 15, 2023

Form 44-007

Iowa 44-007 Reconciliation Form is due by

February 15, 2023

File Your W-2/1099 Forms As Early As Possible And Avoid Penalties

Start E-filing NowFiling Requirements of W-2/1099 Tax Forms with the State of Iowa

In order to complete the Form W2/1099 with the State of Iowa, you must have this information readily available.

- Business Details - Name, EIN/SSN, and Address.

- Employee/Recipient Details - Name, EIN/SSN and Contact Information.

- Payment Details - Employees’ Wages/1099-Payments, Federal & State Taxes Withheld.

Iowataxfilings.info - Simplified Tax Filing Software for W2/1099 Forms

Our software provides a simple solution for all size of Businesses (Small, Mid, & Enterprises), and tax professionals to file W-2 online and 1099 forms quickly. Our tax filing software performs an internal audit check to identify errors during e-filing. You can pay in bulk through the pre-paid credits and this way, you won't have to pay for each return every time you file.

To take care of the security we use the latest technology in the industry. If you require any further information, contact our US-based customer support team, through email (support@tax bandits.com) or by phone (704.684.4751).

Check our W2/1099 exclusive features which simplify the tax filing:

Bulk Upload

To file W-2/1099 forms, you can upload all the employers/payers, employees/recipients, information at once with our excel template instead of entering it one by one.

Postal Mailing

To provide copies of W-2/1099 forms to your employees/recipients, just choose the print and postal mail option and we will print and post mail copies to your employees/recipients on your behalf.

Print Center

You can access the already e-filed 1099/W-2 copies at any time, and you can print and provide the copies if the employees/recipients missed & request you for the copies.

You can also file federal forms such as 941/940/944, 940/941 Sch R, Tax Extension Forms with us.

Click here to know more about our supported Forms & features.

How to E-file 2022 Form W-2/1099 for the State of Iowa?

You can complete W-2/1099 for the Federal & State of Iowa in few steps. Create your free account with the basic information to get started with the e-filing process.

Choose the respective form (W-2/1099) and follow simple steps:

Enter Business (Name, EIN/SSN, and Address)details

Add Employee's/Recipient's (Name, EIN/SSN, and Address) details

Enter Payment details including Employee's/Recipient's earnings, Federal & State taxes withholdings, etc.,

Finally, Review, Pay and Transmit the Form

Iowa Paystub Generator

Whether you're in Des Moines, Cedar Rapids, Davenport or anywhere in Iowa state, our

Iowa paystub generator will calculate the taxes accurately. There is no need for desktop software. Save time and money with the paystub generator that creates pay stubs to include all company, employee, income and deduction information. Just follow the simple steps and email your paycheck stub immediately, ready for you to download and use right away.